Excitement About Appliance Financing

Table of ContentsRumored Buzz on Appliance FinancingAppliance Financing - QuestionsAppliance Financing Can Be Fun For EveryoneAppliance Financing Things To Know Before You Get ThisAppliance Financing Fundamentals Explained

In addition, renting appliances may cost you more money. people obtain personal financings for a variety of factors. Typically, the lender doesn't examine what you are utilizing the money for and even ask (appliance financing). You get the cash as a round figure and afterwards spend it as you pick. Attempt to just take out the quantity you need so you don't spend too much or go into as well much financial debt.You can purchase the device during this time and also then pay it off prior to the credit scores card starts gaining rate of interest. Financing home appliances can come with many benefits.

You don't require to stress over draining your savings account or savings to get an appliance. Financing can give you with a means to obtain the appliances you require and also make the payments back month by month. A few other advantages consist of: Construct your credit report, Increase your credit report if you make settlements on time, Some offer 0% passion, Obtain a new device to enhance the value of your house This depends on the finance you took and also exactly how huge it is.

The loan provider will give you a layaway plan with all the funding terms set out - appliance financing. It will certainly inform you the length of time your term is for as well as how many months or years it will certainly take you to settle. Sometimes, you may be incentivized to pay the lending off early.

Get This Report about Appliance Financing

Many funding terms last between 2 to 7 years for individual financings. A home appliance is normally a smaller sized acquisition than various other house improvement alternatives, so it may not take you long to repay. Some loans might only be twelve month. Check the site you are wanting to get the appliance from.

This could be the most practical choice. However, don't be fooled by comfort or strong print marketing. Thoroughly evaluate the small print, cost of the actual home appliance, and various other options prior to moving on. Buying online for devices and also funding deals can help you get ready for your browse through to the store, if without a doubt you do in fact need to head to the store.

Luxury appliances that are brand-new as well as much more costly can be tougher to certify for. If you can boost your credit history score, funding devices need to be much more expense effective as well as easier to qualify for.

The House Depot Customer Credit score Card offers an advertising 0% interest price for 6 months on acquisitions of $299 or even more. If you wait on a seasonal promo you may discover a longer amount of time for the rate of interest totally free funding. Realize that if you miss a payment you might be billed for the full rate of interest quantity.

Not known Incorrect Statements About Appliance Financing

Consumers have a variety of alternatives, consisting of co-branded charge card, check my reference a Sears card, and also residence funding. These cards function in a similar way to Lowes you gain points which can be retrieved at any kind of Sears location. The Sears House Provider is for financing major home enhancement jobs, where they also assist in setup as well as maintenance.

There are hassle-free alternatives offered to you, whatever type of appliance you're searching for. If you desire to understand exactly how to finance home appliances, here are your most effective choices. Much of the retail stores like Lowes and also Costco do not have flexible financing options aside from debt cards that consist of incentive programs.

A personal loan or home appliance lending can be a smart way to fund appliances, especially if you are planning on acquiring even more than one. Compared to credit rating cards, individual car loans usually have much reduced passion rates.

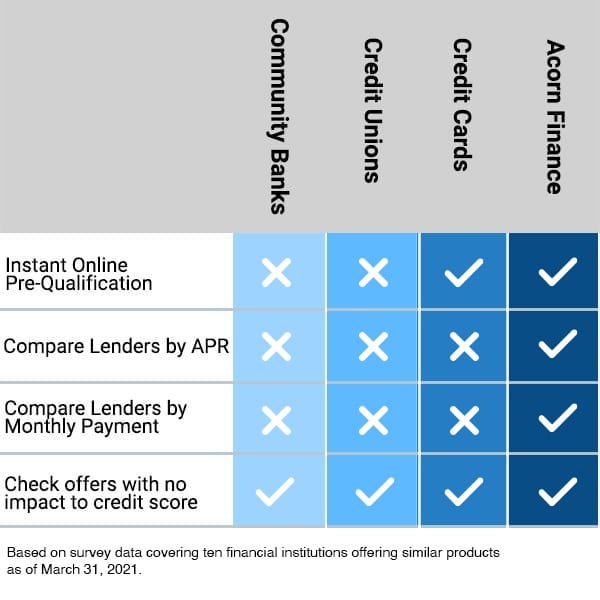

At Acorn Finance you can inspect personal loan offers within 60 secs or less without influencing your credit history. If this is your finest option, make certain you shop around for the very best prices and also make a decision very carefully. You want to determine what's budget-friendly for you. There are homeowners that want even more versatility over their home appliances not just in regards to financing, but having the ability to return them any time.

The smart Trick of Appliance Financing That Nobody is Discussing

Similarly you rent a home, you rent out the home appliances that are positioned inside it. Every settlement renews your lease and also you're welcome to quit your payments any time and return the home appliance. If you pay for long sufficient, you might wind up paying for the thing outright.

Residence enhancement isn't cheap, but occasionally it comes to be a "need to do" rather than a "wish to." When that holds true, a charge card from Residence Depot could be just the ticket, especially for emergency situations that come with a high cost. House Depot offers a variety of bank card, including customer cards and also business cards.

The fundamental House Depot charge card supplies a promotional 0% rates of interest; after that, the annual percent rate (APR) varies from 17. 99% to 26. 99%. House Depot additionally offers a job loan charge card, which functions a lot more like a line of debt, with a limited quantity of time to pay back over here a balance as high as $55,000.

See This Report on Appliance Financing

For purchases of greater than $299, House Depot provides 0% interest for six months and also various other promotions throughout the year. You can often locate 12-month interest-free financing on home appliances of $299 or even more, 24 months of unique funding on heating and also cooling, and seasonal offers, such as $25 off snow blowers in the fall.

The 0% funding creates a great headline, yet it's just complimentary if you comply with the regulations. Like any kind of various other "deferred rate of interest" promo, 0% for 6 months indicates that you have to pay the equilibrium in full prior to the 6 months run out. If you're even someday late, Citi (the bank behind the Home Depot charge card) will certainly charge you the full interest quantity for the past six monthsas if the promotion never ever existed.

If you don't have a background of consistently paying your charge card balances in complete at the end of the month, it's finest to guide clear of marketing deals like these. Keep in mind that installment plan cards are "private tag" and differ basic usage bank card that have a Master, Card or Visa logostore cards can just be made use of at the store, whereas general usage cards can be utilized at any type of seller that approves them.